CCTV News:The People’s Bank of China issued an announcement on September 29th to guide the interest rate of existing mortgage loans to be lowered in batches. At the same time, the self-discipline mechanism of market interest rate pricing issued an initiative to lower the interest rate of existing mortgage loans in batches.

The People’s Bank of China issued an announcement to improve the interest rate pricing mechanism of commercial individual housing loans. At the same time, the self-discipline mechanism of market interest rate pricing issued an initiative. In principle, all commercial banks should carry out batch adjustment of eligible stock mortgages before October 31, 2024, and uniformly adjust the stock mortgage interest rate above -30 basis points on the loan market quotation rate (LPR) to not less than -30 basis points, and not less than the lower limit of the newly issued mortgage currently implemented in the city, so that the interest rate level is close to the national new mortgage interest rate, and the average decline is expected to be about 0.5 percentage points.

Wang Qing, chief macro analyst of Oriental Jincheng, said that two signals were released, the first one was to boost residents’ consumption, and the second one was to promote the real estate market to stop falling and stabilize. It is equivalent to giving "reassurance" to families with existing mortgages, which is conducive to promoting the real estate market to stop falling and stabilize as soon as possible and avoid affecting household consumption.

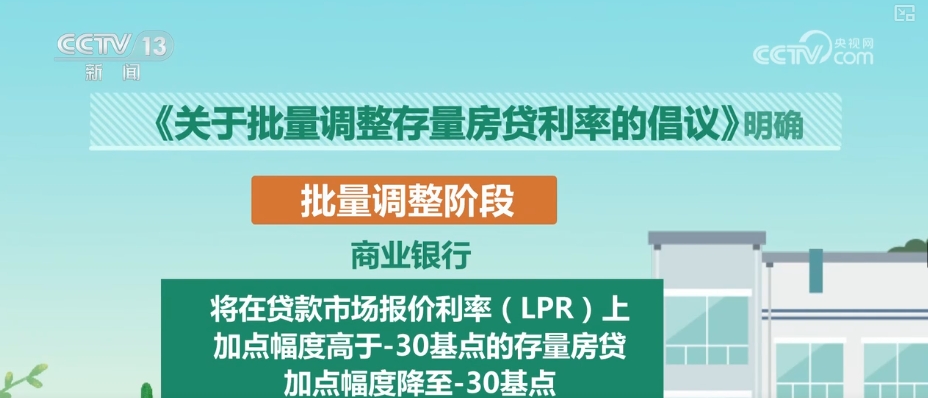

Unified adjustment to the loan market quotation rate of -30 basis points.

What level can the borrower’s interest rate drop after batch adjustment? According to industry insiders, due to the different repricing dates, the interest rates of different borrowers will be different after batch adjustment, but after the repricing date, the interest rate will drop to the vicinity of the national new mortgage interest rate.

The "Initiative on Batch Adjustment of Interest Rate of Stock Mortgage" clearly states that in the batch adjustment stage, commercial banks will reduce the increase range of stock mortgage above -30 basis points on the quoted interest rate (LPR) of the loan market to -30 basis points, and it will not be lower than the lower limit of the newly issued mortgage currently implemented in the city. Simply put, it is a unified adjustment to the loan market quotation rate (LPR)-30 basis points.

By the end of July, the weighted average interest rate of all existing mortgages was about 4.06%. In the first eight months of 2024, the average interest rate of new mortgage loans nationwide was 3.61%. According to the initiative, the interest rate of existing mortgage loans will be reduced to about 3.55% after batch adjustment. After adjustment, the interest rate will be reduced by about 0.5 percentage points compared with the 4.06% before adjustment, and the expected decline is average, which will be different for each contract.

It is estimated that the policy will benefit 50 million families.

After the adjustment, how much interest can buyers save?

Take the stock mortgage with a maturity of 1 million yuan, 25 years and equal repayment of principal and interest as an example. Assuming that the interest rate of the mortgage is reduced from 4.4% to 3.55%, the borrower’s interest expense can be saved by about 5,600 yuan per year. After the batch adjustment is completed, it is expected that this policy will benefit 50 million families and 150 million people, and save 150 billion yuan for the families with existing mortgages every year.

Experts said that after the adjustment of the stock mortgage, the early repayment will be significantly reduced, which will also help banks stabilize the loan scale and improve the loan quality.

Support first-tier cities to make good use of the autonomy of real estate market regulation

On the evening of September 29th, the Ministry of Housing and Urban-Rural Development said that it supports cities, especially first-tier cities, to make good use of the autonomy of real estate market regulation and adjust the housing purchase restriction policy due to the city’s policy.

The Ministry of Housing and Urban-Rural Development said that all localities should respond to the concerns of the masses, support cities, especially first-tier cities, to make good use of the autonomy of real estate market regulation, and adjust the housing purchase restriction policy according to the city’s policy. It is necessary to strictly control the increment of commercial housing construction, optimize the stock, improve the quality, give play to the role of urban real estate financing coordination mechanism, increase the approval of "white list" loans for projects, meet the reasonable financing needs of real estate projects, and fight a tough battle to ensure the delivery of commercial housing projects.

Wang Ruimin, an associate researcher at the Institute of Market Economy of the State Council Development Research Center, said that the Ministry of Housing and Urban-Rural Development supports cities, especially first-tier cities, to make good use of the right of independent regulation of the real estate market. He believes that it has positive boosting value and significance for boosting the confidence of the real estate market in first-tier cities and even the confidence of the national property market. First-tier cities are a weather vane of the national real estate market, and the recovery of the housing market in first-tier cities will also help boost the national real estate market and stabilize it as soon as possible.

The Ministry of Housing and Urban-Rural Development requires that all localities should actively implement urban renewal actions and make efforts to build green, low-carbon, intelligent and safe "good houses". Accelerate the transformation of villages in cities, dilapidated houses in cities and old urban communities, strengthen the renovation of urban underground pipelines, and improve urban infrastructure and public service facilities.

Establish a long-term mechanism for adjusting the interest rate of existing mortgage loans

The announcement issued by the People’s Bank of China this time has also established a long-term mechanism for the gradual and orderly adjustment of the interest rate of existing mortgage loans. If the new mortgage interest rate continues to decline in the future, when the existing mortgage interest rate deviates to a certain extent from the national new mortgage interest rate, the borrower can negotiate with the bank and apply for lowering the existing mortgage interest rate to near the new mortgage interest rate level.

A package of real estate financial measures has accelerated.

On September 29th, the People’s Bank of China and the State Financial Supervision and Administration Bureau also issued a notice to further optimize the real estate policies such as the minimum down payment ratio of individual housing loans and the refinancing of affordable housing.

The People’s Bank of China and the State Financial Supervision and Administration Bureau issued a notice, for households who purchase houses by loans, commercial personal housing loans will no longer distinguish between the first and second houses, and the minimum down payment ratio will be no less than 15%.

At the same time, it also announced that the application period of policies such as supporting the reasonable extension of stock financing such as development loans and trust loans will be extended to December 31, 2026.

The People’s Bank of China also decided to adjust and optimize matters related to the refinancing of affordable housing. For eligible loans issued by financial institutions, the proportion of refinancing loans issued by the People’s Bank of China to financial institutions has increased from 60% to 100% of the loan principal.

Shanghai, Guangzhou and Shenzhen adjust housing purchase restriction measures

Just after the statement made by the Ministry of Housing and Urban-Rural Development on the evening of September 29th, Shanghai, Guangzhou and Shenzhen successively announced the adjustment of purchase restriction measures. Previously, Nansha District of Guangzhou had announced the complete cancellation of the housing purchase restriction policy. According to industry insiders, the pace of adjustment of purchase restriction policies in first-tier cities is expected to accelerate further.

On the evening of September 29th, Shanghai announced that it would shorten the social security or individual tax period for non-Shanghai residents to buy houses outside the Outer Ring Road, and improve the housing purchase treatment for those who hold the Shanghai Residence Permit and have reached the standard score. At the same time, implement a more differentiated housing purchase policy in the Lingang New Area of the Free Trade Zone.

Subsequently, Guangzhou announced the complete cancellation of various purchase restriction policies for households to purchase houses, and Shenzhen also announced the optimization of the purchase restriction policy for partitioned houses. Compared with the three cities, Guangzhou was completely abolished, while Shanghai and Shenzhen were further optimized and adjusted on the original basis. In fact, before this, on September 27, Nansha District of Guangzhou announced the full liberalization of housing purchase restrictions, and no longer reviewed the qualifications for purchasing houses.

At present, some cities in Beijing, Tianjin and Hainan are still implementing the purchase restriction policy and have not been further adjusted. In the eyes of the industry, it is expected that before and after the "Eleventh", other cities are expected to further narrow the scope of the loan restriction policy, and accelerate the follow-up implementation of lowering the down payment ratio and mortgage interest rate of second homes to better support the demand for improved housing.

关于作者