"In the first quarter of this year, Mercedes-Benz developed healthily and steadily with high quality in China, and the sales of high-end luxury brands and new energy vehicles both achieved double-digit growth." Jan Madeja, President and CEO of Beijing Mercedes-Benz Sales & Service Co., Ltd., said that the appearance of a number of heavy-duty pure electric vehicles of Mercedes-Maibakh, Mercedes -AMG and G-class off-road vehicles will interpret a new definition of sustainable luxury travel and create diversified luxury experiences for different customer groups.

Revealing the daily limit | The upcoming Global Game Developers Conference will strengthen the game and cultural media sector.

On March 13, the three major stock indexes of A shares closed down, closing at a daily limit of 62 shares (including 5)ST shares); 30 strands failed to seal the board, and the overall sealing rate was 67%.

Battlefield of daily limit: over 700,000 hands pay the bill to raise money.Xingguang stock

securitiesAccording to the statistics of Times and DataBao, from the closing daily limit, the number of closed orders was the highest, with 717,200 lots; Followed byZhongdian xingfa、Rongji softwareThe daily limit orders were 568,800 lots and 311,000 lots respectively.

Calculated by the amount of the seal,The amount of 5-share seal exceeds 100 million yuan,China softwareThe amount of sealing orders was the highest, with 362 million yuan, 293 million yuan and 199 million yuan respectively.

Judging from the number of consecutive daily limit days,Aiai precision work、Lihang technology7 boards,Ming pu guang ci, 4 connecting plates,,Zhangyue technology、Yinglian stock、Putian technology3 even the board,,Winning numbers jewellery、Ji’ nan high-tech、Caesar cultureEqual to 9 strands and 2 boards.

Besides,ST huatie6 th, 4 boards,*ST meisheng5 th, 3 boards,Luoxin pharmacy2 boards on the 4th,Beijing kerui、Baw blue valley、ST Shuguang3 rd, 2 boards.

Leading the finishing touch:new energyMulti-share daily limit of automobile industry chain

1. Automobile industry chain

Daily limit stocks:,Lan hai Hua Teng、Songzhi stock、Shanzi stock、Yingli automobile、Dongan power、Baida precision work

March 12 th news,Xiaomi automobileIt is officially announced that Xiaomi SU7 will be officially listed on March 28th, 2024. On March 11th, the director of the State Financial Supervision and Administration said that he was studying to reduce the down payment ratio of passenger car loans and further optimize the pricing mechanism of auto insurance.

: On March 13th, the Ministry of Industry and Information Technology released the 381st batch of "Announcement of Road Motor Vehicle Manufacturers and Products", which included the brand-new smart choice vehicle Enjoying S9 jointly built by Huawei and Beiqi Blue Valley, and the production place was the Beiqi Factory in Caiyu Town, Daxing, Beijing.

: wholly-owned subsidiaries Wuxi, Xu Xuehai and Xinneng.Venture capitalThe establishment of Wuxi Huateng Xinneng will focus on the early stage of Huateng Xinneng.fuel batteryTechnical reserve and research and development of automobile drive system, plug-in hybrid electric vehicle drive system (including extended range) and new energy marine drive system.

: The company has obtainedJACThe passenger car thermal management project cooperated with Huawei is still in the development stage, and the production has not been actually scheduled, which will generate sales revenue after mass production.

2、gameandCultural media

Daily limit stocks:Borui spread、Century huatong、Mingchen healthy、Dasheng culture、、Huicheng technology

In the news, the Global Developers Conference will be held in San Francisco from March 18th to March 22nd, Beijing time.

: Two companies under the company belong to game developers, and independently research and develop well-known IP such as "Chivalrous Road".online gameThe product line covers mobile games, page games and end games.

: AI Xinghe is a project that the company explores the field of "game+medical care" by combining AI and VR technologies.

3、Xinchuang

Daily limit stocks:, Rongji software,Jiuqi software、enormous data

In the news, Huawei Shengsiartificial intelligenceThe framework summit will be held on March 22, 2024.

: The company’s position in the operating system industry of Galaxy Kirin continued to consolidate, and its market position remained ahead.

Rongji software: the company undertakes government affairs.cloud computingPlatform, engineering, information security and other major national information projects, as well as core business support systems and key common technology platforms in many industries.

The company is mainly engaged in the research and development of report management software, e-government software, ERP software and business intelligence software, and its product line mainly covers government reports and statistics. existbig dataThe application field introduces industry solutions focusing on finance and taxation.

Dragon and Tiger Stand: Net Buy of Dragon and Tiger ListCitic HaizhiOver 80 million yuan

In today’s dragon and tiger list,Insai group、、Shenzhou high-speed rail、Boshi stock, American new technology,Beilong precision、Chuanrun stock,, Lanhai Huateng and others are on the list.

Among them,,, were the top three net purchases in the Dragon and Tiger List that day, with 82.7471 million yuan, 69.0448 million yuan and 41.9992 million yuan respectively.

Among the stocks on the list of institutional seats, the top three net purchases areHuaci stock、Xingyuan zhuomei, 4.0402 million yuan, 1.3746 million yuan and 166,000 yuan respectively.

ShengutongNet selling of dedicated seatsHigh-tech development56.8152 million yuan, 55.1538 million yuan.Shanghai Stock ConnectNet purchase of dedicated seatsGuoguang electricity23.7335 million yuan,Dongmu stock20.2571 million yuan.

In terms of hot money, Huaxin Xi ‘an Branch bought a net amount of 73.0073 million yuan from CITIC Haizhi;Citic jiantouThe sales department of Qinghe East Road in Guangzhou sold century huatong 71,291,700 yuan.

Disclaimer: All information in DataBao does not constitute investment advice, and the stock market is risky, so investment should be cautious.

Christmas season is coming, and the street festivals in Paris, France are full of flavor.

How did the United States hurt the world by raising interest rates ten times?

A few days ago, the Federal Reserve made its 10th decision to raise interest rates in the past 14 months, which once again triggered market shocks. Continued interest rate hikes have not only brought the United States closer and closer to the economic recession, but also caused the whole world to take the blame for the United States.

Europe, which is the most tightly bound by American strategy, took the lead in responding, followed by the United States to raise interest rates passively for the seventh time since July last year.

△ Yahoo News reported that the European Central Bank held a monetary policy meeting on May 4 and decided to raise the three key interest rates in the euro zone by 25 basis points. The main refinancing rate, marginal lending rate and deposit mechanism rate were raised to 3.75%, 4.00% and 3.25% respectively from the 10th of this month.

However, the analysis believes that the monetary tightening policy has led to the continued weakness of the euro zone economy, and the European Central Bank will still be in a dilemma between curbing inflation and seeking economic growth.

△ US Consumer News and Business Channel website reports: According to Eurostat data, in the first quarter of this year, the GDP of the euro zone only increased by 0.1%, which was less than expected, and the German economy stagnated.

This dilemma is certainly not limited to Europe.

Due to the hegemony of the US dollar, the Fed’s aggressive interest rate hike this round made the yield of US bonds rise and the US dollar strengthened rapidly. Its spillover effect induced large-scale capital to flow to the United States, which made the stock markets, foreign exchange markets and bond markets of many countries suffer violent impacts, forcing these countries to follow the interest rate hike in order to maintain macroeconomic stability, thus increasing their own economic recession risks.

△ Most central banks in the world are raising interest rates at a synchronous rate that has not been seen in the past 50 years (screenshot of the US "Investment Encyclopedia" website report)

"Fed’s interest rate hike will aggravate the global debt crisis"

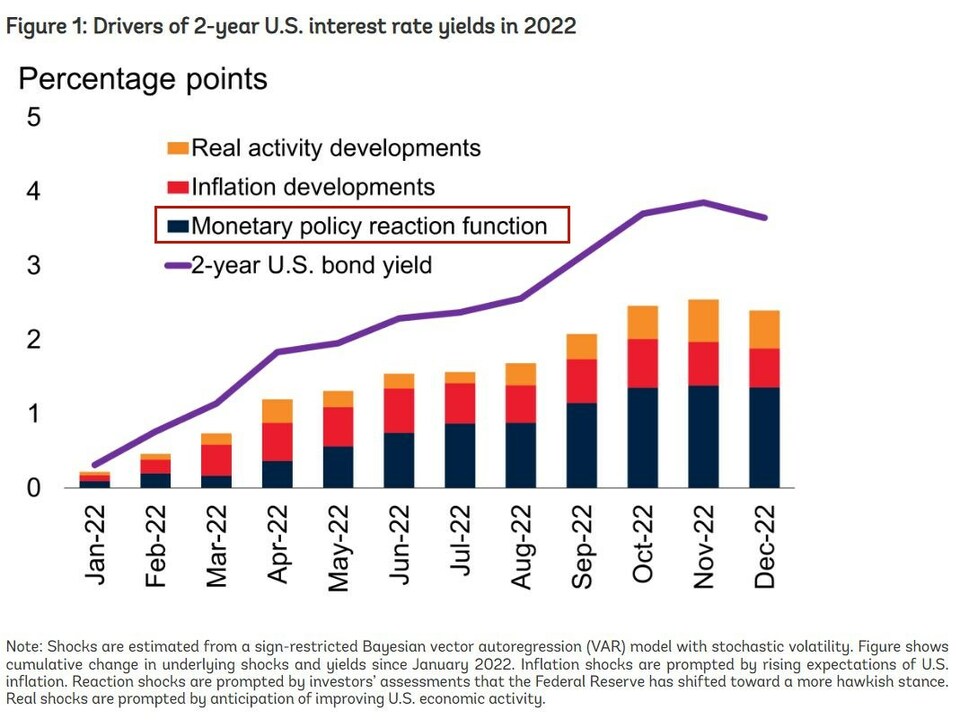

According to the analysis of experts from the World Bank, in the past year or so, the rise of interest rates in the United States was mainly driven by the "reaction shock" triggered by investors’ expectation of the Fed’s shift to a tougher monetary policy stance.

△ Screenshot of World Bank official blog report

The rise in US interest rates driven by "reaction shock" is particularly harmful to the financial markets of emerging markets and developing economies. Facts have proved that the sharp rise in interest rates in the United States and the corresponding rise in the foreign exchange value of the US dollar have had a significant spillover effect on the borrowing costs of emerging markets and developing economies. The debt levels of many emerging markets and developing economies have generally soared, and the debts of many governments have reached record highs. Some countries have fallen into financial difficulties and even defaulted on their debts.

△ The report "Debt Relief for Green and Inclusive Recovery (DRGR)" jointly released by the Center for Global Development Policy Research of Boston University, the Center for Sustainable Finance of the School of Asian and African Studies of London University and the Heinrich Burr Foundation in April shows that during 2008-2021, the sovereign debt of emerging markets and developing economies increased by 178%, from $1.4 trillion to $3.9 trillion.

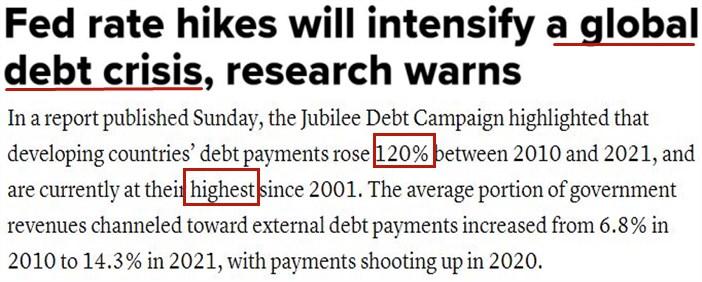

The US Consumer News and Business Channel also warned that the Fed’s interest rate hike will aggravate the global debt crisis. Debt payments in developing countries increased by 120% from 2010 to 2021, reaching the highest level since 2001. The average proportion of government revenue used to pay foreign debts increased from 6.8% in 2010 to 14.3% in 2021.

△ Screenshot of US Consumer News and Business Channel website report

Georgieva, managing director of the International Monetary Fund, warned that the Fed’s interest rate hike may "throw cold water" on the already weak recovery of some countries. The rising interest rate in the United States and the appreciation of the dollar may make it more expensive for countries to repay their debts denominated in dollars.

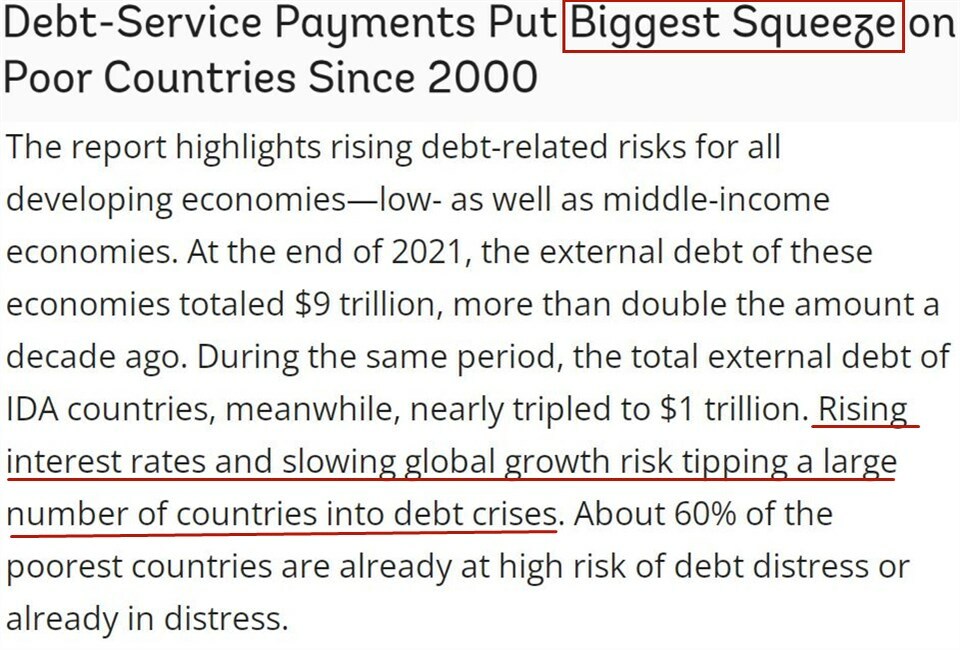

By the end of 2022, the total debt of developing countries rose to a record $98 trillion.

△ World Bank reports in official website: Rising interest rates and slowing global growth are likely to plunge a large number of countries into debt crisis. Debt servicing has brought the greatest pressure to poor countries since 2000.

"Casino capitalism" is accelerating the flight of many countries from the US dollar.

The history of dollar hegemony is the history of the United States arbitrarily harvesting world wealth.

The Australian "East Asia Forum" website once published an article pointing out that in the 1970s and early 1980s, the Federal Reserve led by Paul Volcker reduced the inflation rate in the United States by raising interest rates aggressively, but pushed up the global interest rate, causing many emerging economies to default on their debts. The debt crisis after the Volcker shock made developing countries feel sad. The Fed’s interest rate hike has had a devastating impact on Latin America. The gross domestic product (GDP) in this area plummeted, and the unemployment rate and poverty rate rose sharply. There are similar experiences in debt-ridden countries in Africa. The Fed has not paid enough attention to how its wayward policy choices will affect the rest of the world.

△ Australia’s "East Asia Forum" website report screenshot

This is true. How can the Fed, which holds the hegemony of the US dollar, care about other places? !

Eduardo Porter, an information columnist of Bloomberg, recently questioned: "Can the Fed led by Powell afford to ignore geopolitics?"

The article points out that today, the Fed once again faces the high inflation in the Volcker era. As it is raising interest rates at the fastest rate in more than 40 years, "the original memory of people’s disillusionment with economic prosperity is resurfacing throughout Latin America and the wider developing countries."

△ Screenshot of Eduardo Porter’s commentary reprinted on the Washington Post website.

In connection with the direct and indirect damage caused by the United States’ indiscriminate unilateral sanctions against other countries by using the hegemony of the US dollar for many years, the international community generally believes that the economic and financial policies of the United States have become the biggest challenge to global financial stability, economic recovery and common development.

Faced with the harm of dollar hegemony to the world economy, more and more economies have begun to take practical actions to safeguard their rights and interests. Many countries, including some American allies, have actively explored the path of "dollarization" by reducing US debt, promoting bilateral monetary agreements and diversifying foreign exchange reserve assets. In addition, central banks are still buying gold at the fastest rate since 1967.

△ Reuters reports: In 2022, central banks bought a record 1,136 tons of gold, and in 2023, the trend of global central banks’ gold purchase continued.

With the acceleration of the global "dollarization" process, the control of the US dollar as the world’s reserve currency on the international economic system is weakening. The data shows that in the past 20 years, the share of the US dollar in the international reserves of global central banks has dropped by 12 percentage points, from 71% to 58.36% in 2022, which is the lowest level since the data was recorded in 1995.

△ Screenshot of Turkish Radio and Television Corporation (TRT) website report

Peter Earle, an economist at the American Economic Research Institute, recently pointed out in his article "De-dollarization has begun" that the US dollar has gradually changed from an ordinary carrier of payment, settlement and investment to a financial tool used by the US government to implement unilateral sanctions. Especially after the escalation of the Ukrainian crisis last year, the US wantonly weaponized the US dollar, which accelerated the flight of many countries. "In the long run, ‘ De-dollarization ’ Will continue, and the dollar will lose power overseas sooner or later. "

△ Screenshot of the article on the website of the American Economic Research Institute

Pepe Escobar, a Brazilian geopolitical analyst and senior journalist, called American monetary policy "casino capitalism" in an interview with the media. He pointed out that after weighing the pros and cons, more and more countries found that the US dollar was not safe. The aggressive U.S. sanctions policy and reckless government spending have significantly reduced the international appeal of the dollar. The upcoming BRICS summit in South Africa may be the key to progress in dollarization. The dollar-centered world order is doomed to end.

△ Sputnik news agency & radio report screenshot

Source: Global Information Broadcasting "Global Deep Observation"

Planning Wang Jian

Reporter Shan Lijuan

Editor Yang Nan

Qian Shen Zou Haoyu

Producer: Jiang Aimin

UEFA has cooperated with the parent company of French football, and will jointly hold the Golden Globe Award from 2024.

On November 3rd, UEFA and media company Groupe Amaury (the owner of French football magazine and team newspaper) announced today that they will jointly organize the famous Golden Globe Award from 2024. The common goal of UEFA and Amauri Group is to enhance the status and global influence of the award, and at the same time cultivate the sense of unity and cooperation in football.

Since 1956, the Golden Globe Award has been awarded by the French football magazine every year, which is the most prestigious honor that a football player can get in recognition of the outstanding achievements and extraordinary talents of the award-winning players. As part of the agreement, Amauri Group remains the owner of the Golden Globe brand and will continue to supervise the voting system, which will remain unchanged and independent. UEFA will contribute its football expertise, market global commercial rights and organize the annual awards evening.

In addition, the plan will add two new awards, the Men’s Football Team and the Women’s Football Team Coach of the Year Award, which will recognize the valuable contribution of coaches. The current trophy lineup will keep the same names as before, namely, Golden Ball Award for Men’s Football Team, Golden Ball Award for Women’s Football Team, Copa Award (U21 Best Player), Yaxin Award (Best Goalkeeper), Gade-Mueller Award (Top Shooter last season), Club Award for Men’s Football Team, Club Award for Women’s Football Team and Socrates Award (Humanitarian Contribution).

UEFA President Cheferin said: "In the past 70 years, the Golden Globe Award has been the most prestigious personal honor in football, a proof of the extraordinary skills, dedication and influence of football legends, and an immortal mark left by them in the history of football. The competitions between UEFA clubs and national teams, such as the Champions League and the European Cup, are considered to be the highest stage for elite players in the world, and usually play a key role in the candidates for major honors and their position in the football temple. UEFA and Golden Globe are synonymous with sports Excellence, so our cooperation will be a natural integration of Excellence and synergy, which will be unparalleled. "

Jean-étienne Amaury, CEO of Amauri Group: "The Golden Globe Award is the dream award of the greatest players in the world. We hope that the Golden Globe Awards Ceremony will become a global event to showcase and highlight the individual and collective performances of top football players, inspire all football talents, and aim to gather the passion and enthusiasm of fans from all over the world. "

This cooperative relationship has further consolidated the relationship and historical ties between UEFA and Amauri Group, which can be traced back to more than half a century ago, when Team Newspaper contributed to the idea of creating the European Champions Cup, which has become the world’s top club competition, that is, the current European Champions League.

(eagle)