Beijing Zhengban Fa [2012] No.16

The people’s governments of the districts and counties, the commissions, offices and bureaus of the municipal government, and the municipal institutions:

In order to thoroughly implement the spirit of the document "Opinions of the General Office of the State Council on Strengthening and Improving the Rescue and Protection of Vagrant Minors" (No.39 [2011] of the State Council) and further improve the rescue and protection system of vagrant minors in this Municipality, with the consent of the municipal government, we hereby put forward the following opinions on strengthening and improving the rescue and protection of vagrant minors in this Municipality:

One,Attach great importance to and strengthen the organization and leadership of the rescue and protection of homeless minors.

It is an important duty of governments at all levels to rescue and protect homeless minors in a timely and effective manner. All districts, counties and departments should attach great importance to it, from the perspective of safeguarding people’s livelihood, maintaining social harmony and stability in the capital and building a world city with China characteristics, establish and improve the working mechanism of "government-led, civil affairs-led, departmental responsibility, and social participation" for the rescue and protection of homeless minors, make overall plans, and earnestly strengthen the organization and leadership of the rescue and protection work. Establish a joint meeting system for the rescue and management of vagrants and beggars led by the municipal civil affairs department, and coordinate the rescue and management of vagrants and beggars in the city as a whole. All districts and counties should establish a rescue and protection mechanism for homeless minors led by the leaders in charge of the government. It is necessary to clarify the division of responsibilities and assessment methods, improve the four-level rescue and protection network system of cities, districts, counties, streets (towns) and communities (villages), focus on preventing minors registered in this city from going out to wander and beg, minimize the phenomenon of minors wandering in this city, and resolutely put an end to illegal and criminal acts such as coercion, deception and begging by minors.

Two, the implementation of policies to safeguard the legitimate rights and interests of homeless minors

Doing a good job in the rescue and protection of homeless minors is related to the protection of the legitimate rights and interests of minors and social stability, involving many departments and strong policies. Civil affairs, public security, urban management, health, human resources and social security, education, transportation, railways and other departments should give full play to their functions in accordance with the division of responsibilities, and incorporate the rescue and protection of homeless minors into the overall arrangement of their work. Severely punish behind-the-scenes organizers who abandon minors, coerce, trick or use minors to beg, or instigate or abet minors to carry out illegal and criminal activities such as pickpocketing and looting. Further strengthen social assistance inspections and implement active assistance and classified assistance. Earnestly carry out life care, education, training, management, transportation and return to their hometowns, actively implement the resettlement system for minors who have been stranded for a long time, urge their guardians to fulfill their guardianship and support obligations for minors according to law, implement compulsory education, vocational education, social security policies and assistance policies for minors in need and their families, prevent minors in this city from going out to wander and beg at the source, and earnestly safeguard the basic rights and interests of vagrants and minors.

Three, overall capital investment, strengthen the management of the use of funds.

It is necessary to include the funds of minor rescue and protection institutions and special funds in the financial budget for overall consideration and guarantee. Reasonable formulation of relevant funding standards, according to the rising prices, establish an adjustment mechanism for the living standard of recipients, and effectively ensure the smooth development of the life, education, medical care and resettlement of recipients. Strengthen the management of the use of funds, properly use the special subsidy funds given by the central government, ensure earmarking, and improve the efficiency of the use of funds.

Four, reasonable layout, improve the construction of relief management facilities.

In accordance with the principle of hierarchical management, we should rationally plan and make overall arrangements for the construction of rescue management facilities in cities, districts and counties to ensure a reasonable scale and perfect functions. The number of beds in the city’s rescue management station is not less than 600, the total number of beds in the city’s minor rescue and protection institutions is not less than 300, and the number of beds in Chaoyang, Haidian, Fengtai and Shijingshan districts is not less than 150, and the number of beds in Daxing, Tongzhou, Shunyi and Changping districts is not less than 50, and the number of beds in Mentougou, Fangshan, Huairou, Pinggu, Miyun and Yanqing districts is not less than 30, so as to ensure vagrancy and begging. The municipal government’s investment in fixed assets should refer to the rescue workload of all districts and counties, and give certain subsidies to the construction of rescue management facilities.

Five, clear functional orientation, strengthen team building

Further clarify the functional orientation of the city’s homeless minors rescue service system and strengthen team building. Conscientiously implement the spirit of document No.39 [2011] issued by the State Council, and do a good job in the staffing approval of rescue agencies in cities, districts and counties, and the establishment of special post subsidies for rescue management. Make a special business training plan, carry out training step by step and in an organized way, and improve the staff’s policy theory, professional knowledge and basic skills. We will improve the working system of police station and doctor station in minor rescue and protection institutions, and define specific job responsibilities and staffing numbers according to the workload. Teachers in rescue and protection institutions shall be evaluated for their professional titles, employed and managed in accordance with relevant state regulations. Introduce the professional system of social work, employ professional social workers, and provide cultural and legal education, psychological counseling, behavior correction, skills training and other rescue and protection services for aided minors.

Six, actively guide social forces to participate in the rescue and protection work.

Fully explore and make use of social resources to participate in the rescue and protection of minors. Intensify publicity to create a good public opinion atmosphere and social environment for the survival and development of minors with special difficulties. To study and formulate specific policies and regulations to encourage and support social organizations and individuals to participate in children’s welfare and minors’ rescue and protection work, formulate measures for approval, funding and supervision of social forces to set up rescue institutions, and guide charitable organizations to raise funds to carry out various rescue and protection activities. Constantly expand the volunteer team, establish volunteer service bases, carry out international cooperation and exchanges, and strive to improve the socialization level of minors’ rescue and protection work.

Attachment: 1. Joint meeting system of relief management for vagrants and beggars in Beijing

2。 List of members of the joint meeting of relief management for vagrants and beggars in Beijing

April 5, 2012

Attachment 1:

Relief and management of vagrants and beggars in Beijing

Joint meeting system

In order to strengthen the organization and leadership of the rescue management of vagrants and beggars in the city and strengthen the cooperation between departments, with the consent of the municipal government, a joint meeting system for the rescue management of vagrants and beggars in Beijing is established.

I. Main functions

Under the leadership of the municipal government, co-ordinate the management of vagrants and beggars in the city.

(a) to study and formulate major policies and measures for relief management;

(two) coordinate and solve the key and difficult problems in the rescue management work, promote the cooperation between departments, and organize joint special actions;

(three) to guide, supervise and inspect the implementation of relevant policies and measures, timely report the progress of the work, and sum up experience in a timely manner;

(four) to complete other tasks assigned by the municipal government.

Second, the member units

The joint meeting consists of 20 departments, including the Civil Affairs Bureau, the Capital Comprehensive Management Office, the Propaganda Department of the Municipal Party Committee, the Municipal Development and Reform Commission, the Municipal Education Commission, the Municipal Public Security Bureau, the Municipal Bureau of Justice, the Municipal Finance Bureau, the Municipal Human Resources and Social Security Bureau, the Municipal Housing and Urban-Rural Development Commission, the Municipal Transportation Commission, the Municipal Health Bureau, the Legislative Affairs Office of the Municipal Government, the Municipal Urban Management Law Enforcement Bureau, the Beijing Railway Bureau, the Communist Youth League Committee, the Municipal Women’s Federation, the Municipal Disabled Persons’ Federation, the Municipal Higher People The Civil Affairs Bureau is the lead unit of the joint meeting, the director of the Civil Affairs Bureau is the convener of the joint meeting, and the responsible comrades of all member units are members of the joint meeting. The office of the joint meeting is located in the Civil Affairs Bureau and undertakes the daily work of the joint meeting. The director of the office is concurrently a deputy director of the Civil Affairs Bureau. The members of the office shall be the responsible comrades of the relevant offices of each member unit.

If the members of the joint meeting need to be adjusted due to work changes, they shall be replaced by the successor leaders of their units.

Third, the working rules

(a) the joint meeting shall be held once a year in principle, and the plenary meeting or some members’ meetings may be held temporarily according to the needs of the work;

(two) before the joint meeting, a meeting of members of the office of the joint meeting was held to study and discuss the topics of the joint meeting;

(three) the office of the joint meeting is responsible for the collection of meeting topics, minutes, information statistics, decision-making supervision and other daily work;

(four) the joint meeting in the form of meeting minutes clearly agreed matters, issued by the relevant units, and send a copy to the municipal government.

Fourth, the job requirements

Each member unit shall, in accordance with the division of responsibilities, take the initiative to study the relevant issues concerning the rescue and management of vagrants and beggars, actively participate in the joint meeting, conscientiously implement the tasks assigned by the joint meeting, and submit the work to the office of the joint meeting on time as required. All member units should exchange information, cooperate with each other, support each other, form a joint force, give full play to the role of the joint meeting, and jointly do a good job in the rescue and management of vagrants and beggars.

Attachment 2:

Relief and management of vagrants and beggars in Beijing

List of members of the joint meeting

Convenor: Director of Wu Shimin Civil Affairs Bureau.

Member: Xu Jihui, Deputy Director of Capital Comprehensive Management Office

Deputy Inspector of Propaganda Department of Lvqin Municipal Committee

Liu Yinchun, Deputy Director of the Municipal Development and Reform Commission

Deputy Director of Luojie Municipal Education Commission

Li Runhua, Deputy Director of Public Security Bureau

Deputy Director of Chen Weidong Civil Affairs Bureau

Zheng Zhenyuan, Deputy Director of Justice Bureau

Shi Shuying, Deputy Inspector of Municipal Finance Bureau

Chen Bei, Deputy Director of Human Resources and Social Security Bureau

Li Rongqing, Deputy Director of Housing and Urban-Rural Development Committee

Deputy Chief of Traffic Law Enforcement Corps of Jianwei Liang Municipal Communications Commission

Deputy Inspector of Zhao Tao Municipal Health Bureau

Wang Rongmei, Deputy Director of Legislative Affairs Office of Municipal Government

Ma Huimin Deputy Director of Urban Management Law Enforcement Bureau

Chen Jianghe, Deputy Director of Beijing Railway Bureau

Deputy Secretary of Huang Keying Communist Youth League Committee

Vice Chairman of Zhou Zhijun Women’s Federation

Vice Chairman of Wu Xuewen Disabled Persons’ Federation

Vice President of Sunli Higher People’s Court

Deputy Procurator-General of Miaoshengming Municipal People’s Procuratorate

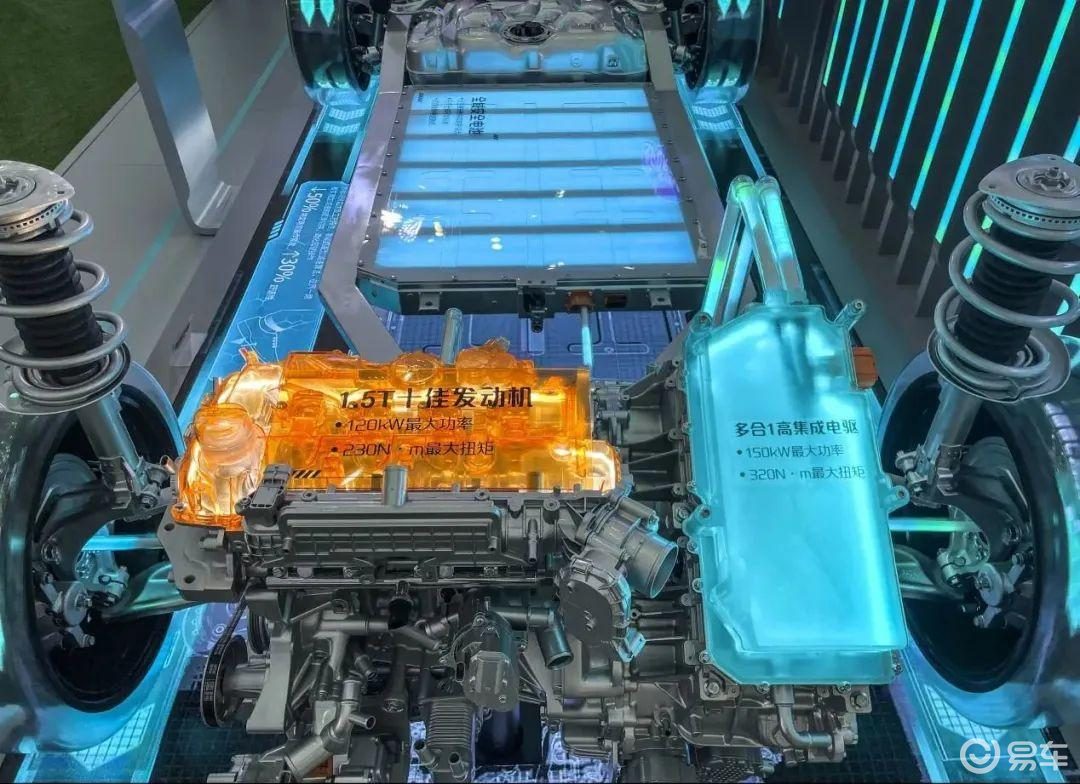

Avenir concept car built by Buick’s global team

Avenir concept car built by Buick’s global team