Wen | Zero One

The Legend of Hunter in Xing ‘an Mountains in 2021 is a symbolic explosion in the development of online movies, and it still ranks first in the box office of online movies in the past three years with a box office score of 44.49 million yuan, which has led to the all-round rise of the sub-category of "folk horror".

After the Legend of Hunters in Xing ‘an Mountains earned a lot of money, in 2022 alone, many folk horror online movies with box office of 20 million and 30 million levels emerged, such as tales of mystery in Yin and Yang Town, Opening the Coffin, tales of mystery in Long Yun Town, Tomb of the Coffin Mountain and Fox Wife in the Mountain Village, which made the folk horror theme account for nearly 40% of the TOP20 online movie box office in 2022, which can be said to have greatly affected the network in the past two years.

On August 11th, 2023, the sequel to The Legend of Xing ‘an Mountain Hunter, Xing ‘an Mountain Hunter 2 Cycle Forest, was released on two major video platforms. Because the box office record set by the previous work is extremely high, many people thought that "Xing ‘anling Hunter 2" was at least a 30 million-level market leader and would become the "shoulder handle" of the summer online movie section.

However, the fact is far below this expectation: in 2021, the box office of The Legend of Xing ‘anling Hunter reached 5.574 million on the first day of its release, which exceeded 10 million in just two days and 30 million in seven days; However, the box office of Xing ‘anling Hunter 2 was only 382,000 on the first day, and the cumulative box office was only 3.71 million six days after its launch, which was less than the fraction of the previous 44.49 million.

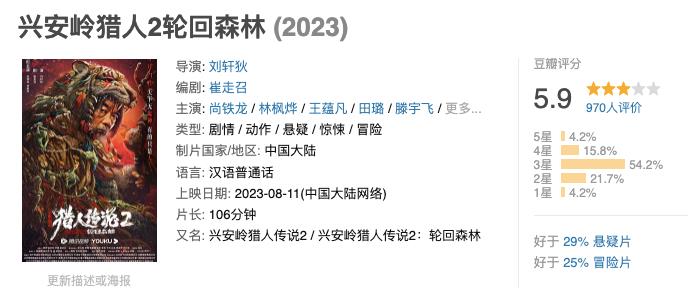

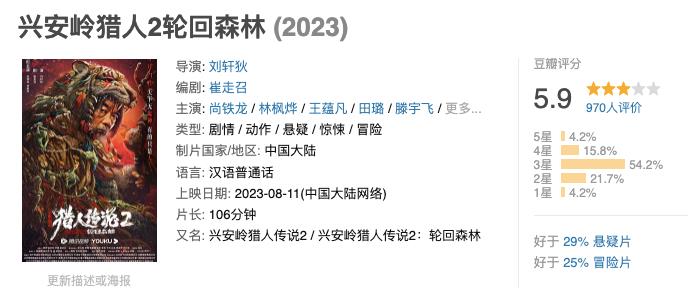

If the quality of the film is very poor, or if the production team sells dog meat, such a box office gap may still make sense, but the fact is that the douban score of Xing’ anling Hunter 2 at present is exactly the same as that of the previous film, which is not bad in the same type of online movies, while the main creative lineups such as director Liu Xuandi, screenwriter Cui Zouzhao and starring Shang Tielong are all consistent with the first film, and basically moved to the previous team, even the story-telling mode and.

Since the conditions are similar, why don’t the audience buy it?

The huge gap between the box office of Xing ‘anling Hunter 2 and its predecessor can be found out from three aspects: content, schedule and marketing.

From the 40 million level to the 4 million level, the douban scores of the two films are the same. In terms of horizontal comparison, the content may not be the main reason for the box office failure. But combined with other factors, it is still the root of all changes.

The general idea of Xing ‘anling Hunter 2 can be described in one word: hold on.

Perhaps because The Legend of Hunters in Xing ‘an Mountains in 2021 greatly exceeded everyone’s expectations, the producers regarded it as a golden rule-like imitation object, and sought for a replica of the box office trend from the content side. This is at least a way that looks beautiful and can reassure investors from all walks of life. The first film is full of money-making effects, and the number of producers and co-producers of Xing ‘anling Hunter 2 has reached as many as 15, which is a very high number in online movies.

Hunter 2 in Xing ‘anling is not only the starring cast of the same director and screenwriter, but also a complete replica of the narrative mode of the first film: the opening begins with the folk horror stories related to fox spirits, even the lines of the old hunter are the same, and the plot also adopts a three-stage short story series.

In all fairness, Xing ‘anling Hunter 2 is not much worse than the first one in terms of story, performance and scene. It basically belongs to the same level, and even the plot design of the story is more mature. But from the perspective of perception, "Xing ‘anling Hunter 2" did not bring any fresh experience, but the market environment was quite different-

Because of the crowded folk theme and aesthetic fatigue, all the online movies of the same type are not satisfactory in 2023. As mentioned above, in 2022, the number of folk horror online movies exploded, and many of them reached more than 20 million at the box office. However, the number of folk horror online movies that have reached more than 20 million since 2023 is zero, and the highest is "The Return of the Paper Man" released in January, which has accumulated 18.7 million so far. In terms of production level, this "The Return of the Paper Man" even far exceeds most of its peers in 2022. Well-made people are still like this, and a lot of other works that follow the trend can only be reduced to cannon fodder.

Therefore, at the moment when the audience is already familiar with this theme mode, taking out a "replica work" instead of a "transcendence work" will definitely not be as good as the previous one. In 2021, the predecessor "Xing ‘anling Hunter" was a trend-setting work. There were not many well-made folk thrillers in online movies. Compared with "Xing ‘anling Hunter", there were a lot of shoddy zombie movies in early online movies.

According to media reports, at that time, one of the producers once shared the concept of topic selection: "We jumped out of the circle of online movies and went to see what kind of themes of cinema movies were not done by online movies, or did not make explosions. After tagging hundreds of cinema movies and online movies based on the logic of users’ consumption preferences, we found that the theme of folklore stories has not been discovered by many people. "

In 2023, the online movie market has experienced a rush of folk horror "theme looting". As mentioned above, there are dozens of folk horror online movies that reach more than 10 million, and many of them are not inferior to Xing ‘anling Hunter only in terms of content quality.

What’s more, the core selling point of the theme is "thriller", and Hunter 2 in Xing ‘anling is not as good as the atmosphere created by the previous work. The story of "opening for 6 minutes" used to attract the audience has few horror elements, which is difficult to meet the needs of the target group to watch. And all the three stories are reversed from the previous ones, in which the horror is the main part, supplemented by the preaching of good and evil, and the horror elements in the stories are greatly weakened, further reducing the visibility of the film.

It is beyond the scope of this article to discuss what considerations or factors have reduced the presentation of thriller elements.

As mentioned above, the content may not be the main reason for the box office failure of Xing ‘anling Hunter 2. Because even in 2023, there are folk horror films that follow the trend with far less quality than Xing ‘anling Hunter 2, which have earned more than 10 million box office, such as "Into the Coffin" in February and "Five Immortals in Northeast China" in April, both of which have earned 10 million+box office receipts.

Therefore, even considering the conservatism of the content before the remake, the sales of Xing ‘anling Hunter 2 should be at least a "small head" with a level of 20 million, and should not be reduced to a level of only over 3 million in six days.

Reading Entertainment Jun believes that an important reason is that the cinema market is too hot and the number of topics is too large since the summer file, which makes Xing ‘anling Hunter 2 dwarfed and in a much worse competitive environment than the first one in April 2021.

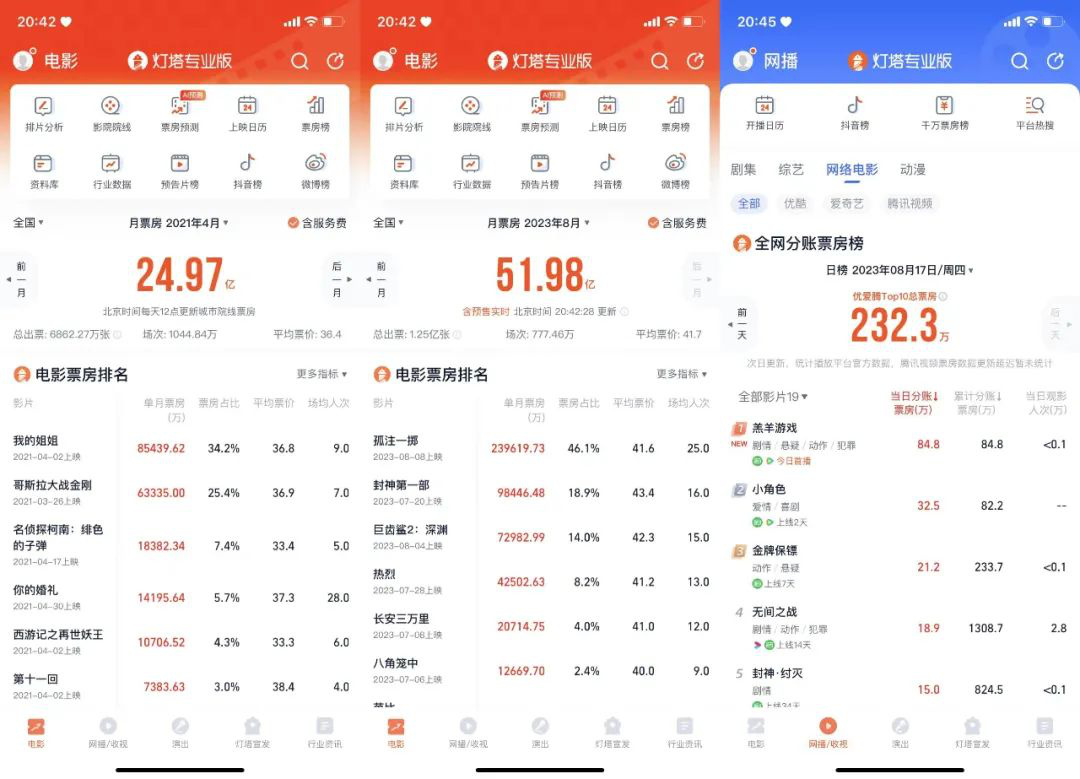

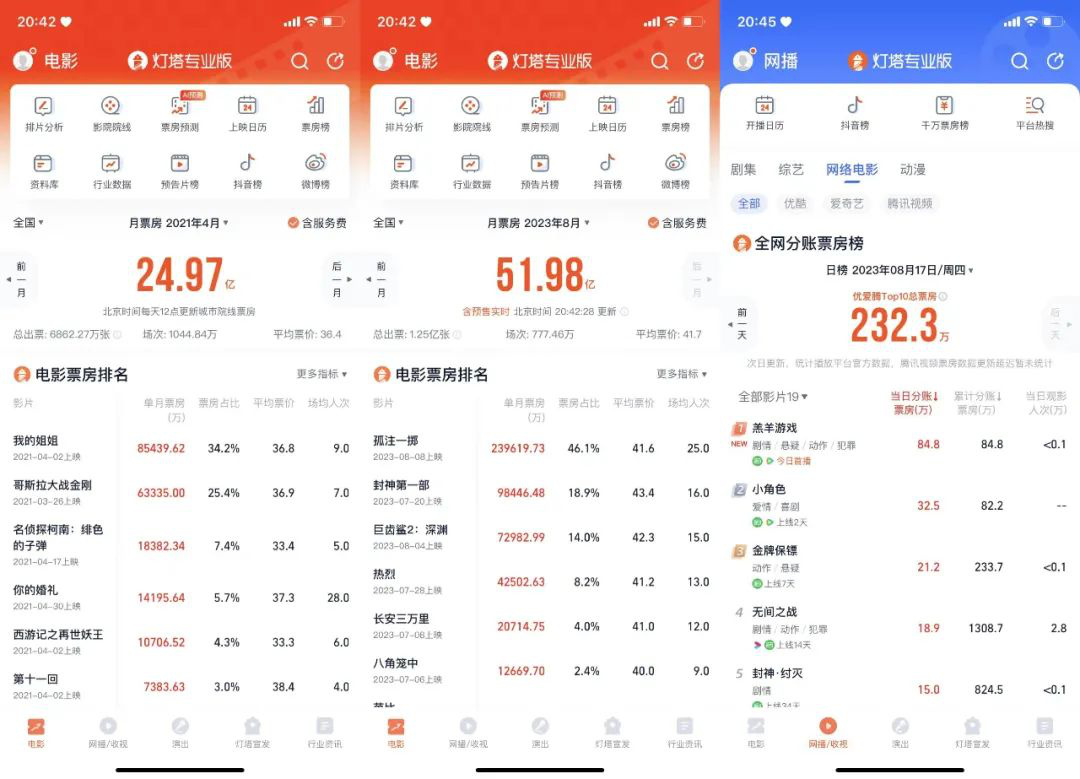

In April 2021, the monthly total box office of the cinema market was 2.497 billion, and the top three were My Sister and Godzilla vs Kong’s Detective Conan’s Scary Bullet. Since August, 2023, it has accumulated nearly 5 billion box office, and the top three are "Put all your eggs in one basket" and "Feng Shen" Meg 2, which is completely out of the order of magnitude in terms of box office and discussion. Since the second week of August, Dengta Data has shown that the single-day box office of online movies is almost only 2 million+,while the single-day box office can almost reach 4-5 million in the same period last year.

The total inclination of the hot topic on the Internet has led to a sharp increase in the difficulty for the online movie "Xing ‘anling Hunter 2" to gain attention in all channels, such as marketing promotion and video platform broadcasting. Although online movies and cinema movies don’t compete on the same level, from the perspective of users’ attention and users’ duration, there will be a trade-off relationship between them to some extent, which can be seen from some "masterpieces" of online movies in the last two months-before "Feng Shen", "Feng Shen: The extinction" which was launched on July 15 has accumulated 8 million.

From the marketing point of view, "Xing ‘anling Hunter 2" is not at the same level as its predecessor. In 2021, "Xing ‘anling Hunter" was released in Tomb-Sweeping Day, which was closely related to the theme. However, the short video marketing of online movies was still in the fresh stage, and the attention competition was far less difficult. Under such circumstances, the producers accurately packaged and promoted their own selling points, and started the short video marketing action more than ten days before the movie went online, and then gradually began to promote the hot search, talent and other sub-sectors, and even found a tiger tooth and a girl outside the station to promote it, which was also obvious from the media.

And in 2023, "Xing ‘anling Hunter 2", we can intuitively see the decrease of its marketing investment or effect:

In recent years, Weibo and short video entertainment marketing, the film and television sector has been occupied by two high-scoring ancient costumes, Lotus House and Sauvignon Blanc, while the film sector is full of such big traffic households as Lost Her, In an octagonal cage, Three Wan Li in Chang ‘an, Put all your eggs in one basket and Enthusiasm, surrounded by crowds, and Hunter 2 in Xing ‘anling has no fresh sales.

However, since July, it is not without a movie in the online movie market that has won attention. "Northeast Police Story 2", which was launched in the cloud cinema in a single-chip payment mode, has achieved a score of 15 million+in the on-demand period. Together with the initial membership period, it is likely to reach the level of more than 35 million in the end.

Perhaps it is the breakthrough of word of mouth, the scarcity of hardcore action types, or the flowering of realistic theme types on the network side … In any case, the future of online movies is always based on innovation, quality production and insight into the aesthetic upgrade of the public. The failure of Xing ‘anling Hunter 2 means that the mode of "living on one’s laurels" is likely to fail in the online movie industry.

As said at the beginning, the content may not seem to be the main reason for the box office failure, but in the final analysis, it must be the root of the difference, because invariability sometimes means the change of the result.

Original article, reprint should indicate the source.